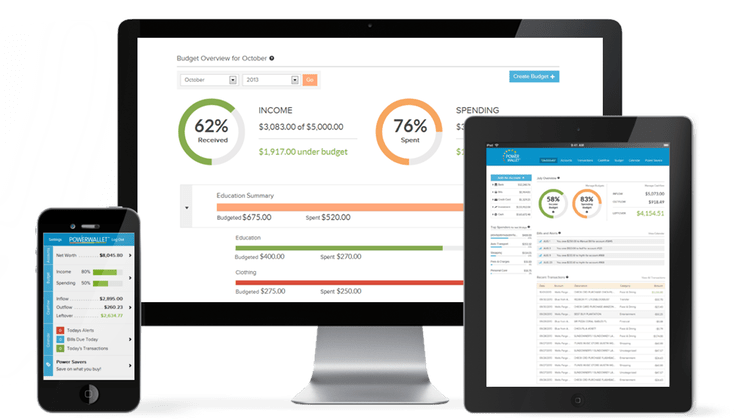

You can also learn more by reading our complete PocketSmith review. Those who are serious about budgeting accurately to realize a major life event down the road, like a wedding, property purchase, or paying for college tuition.Įxpats, digital nomads, dual citizens, and frequent traveller-types who make a lot of foreign purchases and/or have bank accounts in multiple countries. A paid version is available for as little as $7.50 USD per month, which is a worthwhile expense for two types of users:

It relies on you manually uploading your transactions and account balances rather than automatically syncing with your financial institutions. It can only create financial projections up to six months into the future.

#Best budget planning app for mac free

The free version supports a maximum of two financial accounts. Though PocketSmith does offer a free version, its functionality is far more limited than what you’ll get for a paid subscription. You can also see the combined value of all your global assets and liabilities, tallied up and converted to the base currency of your choice. You can see the individual balances of your domestic and foreign accounts in their native currencies.

While most budgeting apps only connect to bank accounts in Canada and the United States, PocketSmith offers a rare level of integration with overseas accounts and foreign currencies. Different ‘what if’ scenarios can also be tested, in which you can adjust projected expenses, income levels, investment performance, and debts to get a glimpse of various financial outcomes for your future. It can collate all your financial info (chequing balance, savings, investments, loans, etc.) and create accurate forecasts of your financial status up to 30 years into the future, based on the budgets you create. PocketSmith stands out from other budgeting apps due to its impressive forecasting abilities. Here are 10 budgeting apps you should consider to help you manage your money Top 10 budgeting apps PocketSmith This isn’t an issue with any particular app but due to a security measure Canadian banks have put in place over the past few years. Note: Due to changes in bank feeds in Canada, users have reported that their automatic connections are unreliable and will frequently disconnect. Luckily, thanks to the popularity of smartphones and an ever-growing array of finance apps, we can now have our own mobile money managers in the palms of our hands. But, budgeting is something most of us must do on our own-at least in the early stages of growing our savings or getting ourselves out of debt. It would be great if we could all afford personal financial managers. Our financial health depends more on how we manage our money than how much we make. Our bank accounts affect whether we can pursue higher education, become homeowners, and retire with financial security. And if you’re concerned about the environment, a paperless planner helps eliminate waste and the carbon footprint that comes with shipping traditional books.Whether we like to admit it or not, money has a powerful influence on our lives.

#Best budget planning app for mac download

And if you’re equally committed to the environment, then a digital planner might be your best bet.įor those who are already tethered to their tablet (say, an iPad, Samsung Galaxy Tab, or an Amazon Fire device), smartphone, or smart notebook, these virtual organizers allow you to keep tabs on your schedule and tasks while eliminating the need to throw yet another book inside your bag.Īnother advantage? If you’re too busy to pick up a planner at a brick-and-mortar shop, or you don’t want buy one online and risk a delayed delivery, the best digital planners let you download and use your organizer immediately. If you’re looking to keep your schedule, ideas, to-do lists and motivational notes-to-self in one place, one productivity tool that never gets dated is a good planner.

Getting more organized tends to be among the top New Year’s resolutions, but it’s something we should be keeping top of mind throughout the year as well. If you purchase an independently reviewed product or service through a link on our website, Rolling Stone may receive an affiliate commission.

0 kommentar(er)

0 kommentar(er)